Delving into the topic of does homeowners insurance cover tenants, this introduction provides a comprehensive overview of what homeowners insurance typically covers for tenants, the key differences in coverage between homeowners and tenants, and scenarios where tenants may be covered under a landlord’s policy.

It also discusses additional coverage options for tenants, the responsibilities of landlords and tenants in terms of insurance coverage, and potential gaps in coverage that tenants may face.

Understanding Homeowners Insurance Coverage for Tenants

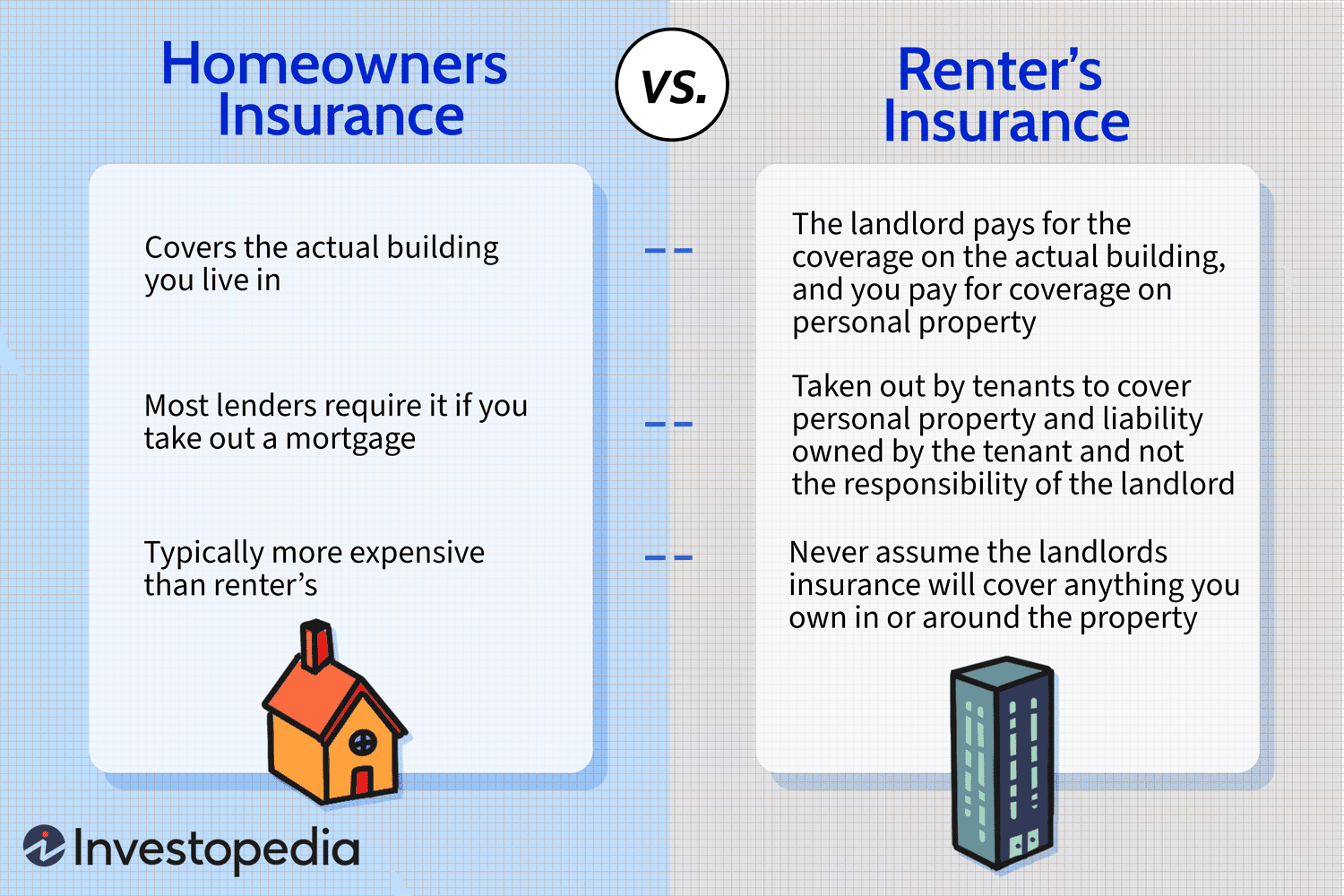

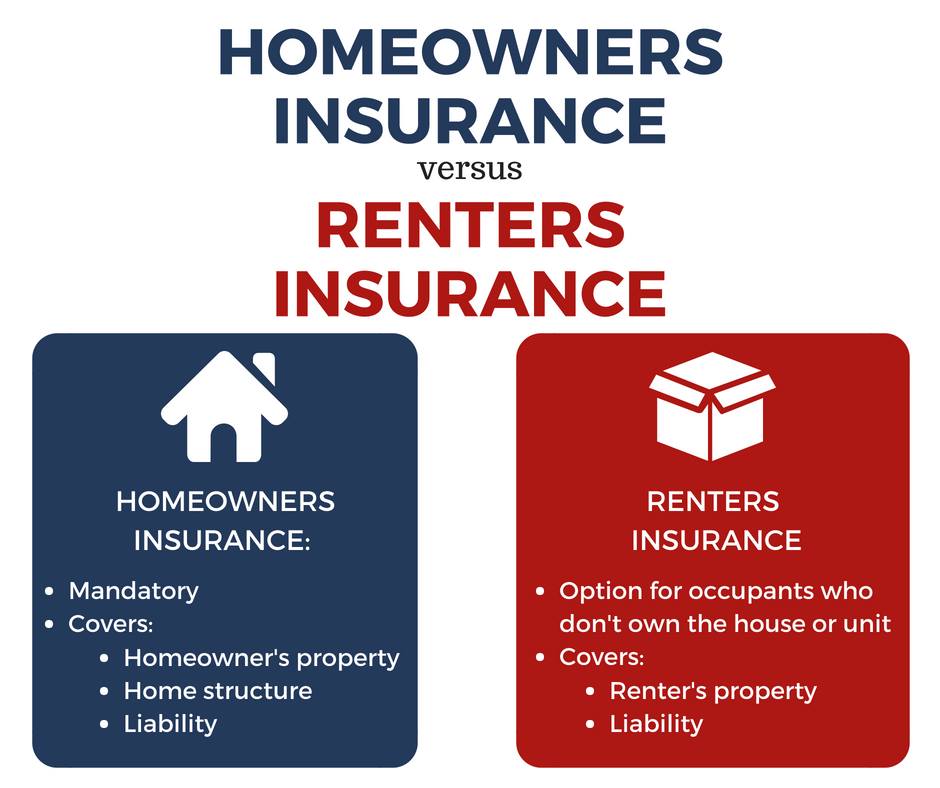

When it comes to homeowners insurance coverage for tenants, it’s important to understand the differences between coverage for homeowners and tenants. While homeowners insurance typically covers the structure of the home, personal belongings, liability protection, and additional living expenses in case of a covered loss, tenants may not have the same level of coverage under a landlord’s policy.

Key Differences in Coverage

- Structure Coverage: Homeowners insurance covers the physical structure of the home, including repairs or rebuilding in case of damage. Tenants are not responsible for insuring the structure as it falls under the landlord’s policy.

- Personal Belongings: Homeowners insurance typically covers personal belongings within the home, such as furniture, electronics, and clothing. Tenants are responsible for obtaining their renters insurance to protect their personal items.

- Liability Protection: Homeowners insurance provides liability protection in case someone is injured on the property. Tenants may not be covered under the landlord’s policy and should consider their own liability coverage.

- Additional Living Expenses: If the home becomes uninhabitable due to a covered loss, homeowners insurance may cover additional living expenses. Tenants should have renters insurance to cover such expenses in case of displacement.

Scenarios where Tenants may be Covered under Landlord’s Policy

In some cases, tenants may be covered under a landlord’s homeowners insurance policy, depending on the circumstances. This can include:

- If the tenant causes damage to the property unintentionally, the landlord’s insurance may cover the cost of repairs.

- If a visitor of the tenant is injured on the property due to negligence on the landlord’s part, the landlord’s liability coverage may extend to the tenant.

- Some landlords may include coverage for tenants in their homeowners insurance policy, but this is not guaranteed. It’s essential for tenants to have their own renters insurance to ensure adequate protection.

Additional Coverage Options for Tenants

When it comes to renting a property, tenants should consider additional coverage options to protect themselves in case of unforeseen circumstances. While homeowners insurance may cover the structure of the building, it may not provide adequate protection for a tenant’s personal belongings or liability.

Renters Insurance vs. Landlord’s Homeowners Insurance, Does homeowners insurance cover tenants

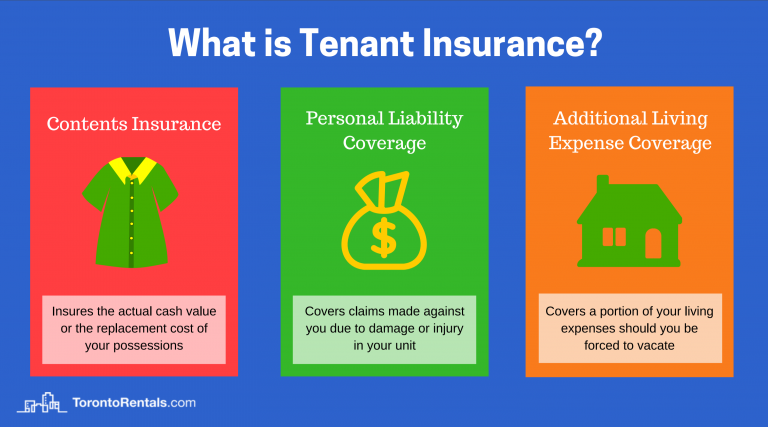

Renters insurance is a policy specifically designed for tenants, covering personal belongings, liability, and additional living expenses in case the rental property becomes uninhabitable due to a covered loss. On the other hand, being covered under a landlord’s homeowners insurance may not provide sufficient coverage for a tenant’s possessions or liability in case of an accident.

Situations Requiring Additional Coverage

- Personal Property Coverage: Renters insurance can protect tenants’ personal belongings, such as furniture, electronics, and clothing, in case of theft, fire, or other covered perils.

- Liability Protection: Tenants may need additional liability coverage to protect themselves in case someone gets injured in their rental unit and decides to sue.

- Additional Living Expenses: In case the rental unit becomes uninhabitable due to a covered loss, renters insurance can cover additional living expenses, such as hotel stays or temporary rentals.

Responsibilities of Landlords and Tenants

When it comes to insurance coverage for rental properties, both landlords and tenants have specific responsibilities to ensure adequate protection in case of unforeseen events.

Landlords are responsible for providing insurance coverage for the physical structure of the rental property, including the building itself, fixtures, and any permanent installations. This coverage typically includes protection against perils such as fire, theft, and vandalism. However, it’s essential for landlords to communicate clearly with tenants about the extent of their insurance coverage and what is expected of tenants in terms of their own insurance.

Landlords’ Responsibilities

- Provide insurance coverage for the physical structure of the rental property.

- Communicate clearly with tenants about the extent of insurance coverage provided.

- Ensure that tenants understand their responsibilities regarding insurance coverage.

Tenants’ Responsibilities

- Obtain renters insurance to protect personal belongings and provide liability coverage.

- Understand the terms and coverage limits of their renters insurance policy.

- Inform the landlord of any significant changes that may affect insurance coverage.

Interaction between Landlord and Tenant Insurance Policies

When both the landlord and tenant have insurance coverage, there can be overlap in certain areas of protection. For example, if a covered event damages the rental property and the tenant’s personal belongings, both insurance policies may come into play. It’s crucial for both parties to understand how their respective policies work together to ensure comprehensive coverage in case of a claim.

Overall, clear communication and understanding of insurance responsibilities between landlords and tenants are essential to avoid gaps in coverage and ensure that both parties are adequately protected in the event of unexpected incidents.

Potential Gaps in Coverage for Tenants

When tenants rent a property, they often assume that their belongings and liabilities are covered under their landlord’s homeowners insurance policy. However, there are common gaps in coverage that tenants may face, which can leave them financially vulnerable in certain situations.

Lack of Personal Property Coverage

One of the most significant gaps in coverage for tenants is the lack of personal property coverage under their landlord’s homeowners insurance. While the landlord’s policy may cover the physical structure of the rental property, it typically does not extend to the tenant’s personal belongings, such as furniture, electronics, and clothing.

To address this gap, tenants should consider purchasing renters insurance. Renters insurance provides coverage for personal property, liability protection, and additional living expenses in case the rental property becomes uninhabitable due to a covered loss.

Liability Coverage Limitations

Another common gap in coverage is liability limitations for tenants under the landlord’s homeowners insurance. If a guest or visitor is injured on the rental property due to the tenant’s negligence, the landlord’s policy may not provide sufficient liability coverage for the tenant.

Tenants can protect themselves by purchasing a separate personal liability umbrella policy. This additional coverage can help fill the gap and provide extra liability protection beyond what is offered by the landlord’s insurance.

Exclusions for Certain Perils

Some landlords’ homeowners insurance policies may have exclusions for certain perils, such as floods, earthquakes, or sewer backups. If a tenant’s belongings are damaged or lost due to one of these excluded perils, they may not be covered under the landlord’s policy.

Tenants should inquire about the specific exclusions in their landlord’s insurance policy and consider purchasing additional coverage, such as a separate flood insurance policy, to fill these gaps in coverage.

Real-Life Example

For example, if a pipe bursts in a rental property and damages a tenant’s furniture and electronics, the landlord’s insurance may cover the repairs to the structure but not the tenant’s personal belongings. Without renters insurance in place, the tenant would be responsible for replacing or repairing their damaged items out of pocket.

Ultimate Conclusion

In conclusion, understanding the nuances of homeowners insurance coverage for tenants is crucial for both landlords and tenants to ensure adequate protection. By exploring the various aspects of coverage, responsibilities, and potential gaps, individuals can make informed decisions to safeguard their interests.

Commonly Asked Questions: Does Homeowners Insurance Cover Tenants

What does homeowners insurance typically cover for tenants?

Homeowners insurance typically covers the physical structure of the property, personal property inside the rental unit, and liability protection for tenants.

What are the key differences in coverage between homeowners insurance for homeowners versus tenants?

The key difference is that homeowners insurance covers the structure and contents of the home owned by the policyholder, while tenants are typically responsible for insuring their personal belongings.

Are tenants responsible for ensuring they have appropriate insurance coverage?

Yes, tenants are responsible for obtaining renters insurance to protect their personal belongings and provide liability coverage for themselves.

Can tenants be covered under a landlord’s homeowners insurance policy?

In some cases, tenants can be covered under a landlord’s homeowners insurance policy, but it’s important for tenants to have their own renters insurance for comprehensive coverage.

What are common gaps in coverage that tenants may face under a landlord’s homeowners insurance?

Common gaps include lack of coverage for tenants’ personal belongings, additional living expenses in case of displacement, and liability protection specific to tenants.